Exam Guide

CA Roadmap

CA Foundation

The CA Foundation exam is a qualifying examination conducted by the Institute of Chartered Accountants of India (ICAI). It tests candidates on four subjects: accounting, business law, economics, and mathematics/statistics. It serves as the entry-level examination for aspiring Chartered Accountants and is held twice a year (May and November). Passing the CA Foundation exam opens the pathway for further studies and practical training to become a professional Chartered Accountant.

In order to qualify for the Foundation Examination scheduled in May/November or June/December, it is necessary for a candidate to have completed their registration with the Institute of Chartered Accountants of India (ICAI) at least four months prior. For instance, to appear for the May attempt, a student must have completed their registration before the 1st of January.

Furthermore, it is mandatory for candidates to have successfully completed the Senior Secondary (10+2) examination conducted by a legally established examining body in India, or an examination recognized by either the Central Government or the State Government as equivalent.

FOUNDATION COURSE

PAPER 1: ACCOUNTING (100 MARKS)

- Theoretical Framework

- Accounting Process

- Bank Reconciliation Statement

- Inventories

- Depreciation and Amortization

- Bills of exchange and Promissory notes

- Preparation of Final accounts of Sole Proprietors

- Financial Statements of Not-for-Profit Organizations

- Accounts from Incomplete Records (excluding preparation of accounts based on ratios)

- Partnership and LLP Accounts

- Company Accounts

PAPER 2: BUSINESS LAWS (100 MARKS)

- Indian Regulatory Framework

- The Indian Contract Act, 1872

- The Sale of Goods Act, 1930

- The Indian Partnership Act, 1932

- The Limited Liability Partnership Act, 2008

- The Companies Act, 2013

- The Negotiable Instruments Act, 1881

PAPER 3: QUANTITATIVE APTITUDE (100 MARKS)

- PART A: BUSINESS MATHEMATICS (40 MARKS)

- Ratio and proportion, Indices and Logarithms.

- Equations

- Linear Inequalities

- Mathematics of Finance

- Permutations and Combinations

- Sequence and Series

- Sets, Relations and Functions. Basics of Limits and Continuity functions.

- Basic applications of Differential and Integral calculus in Business and Economics (Excluding the trigonometric applications)

- PART B: LOGICAL REASONING (20 MARKS)

- Number series coding and decoding and odd man out

- Direction Tests

- Seating Arrangements

- Blood Relations

- PART C: STATISTICS (40 MARKS)

- Statistical Representation of Data & Sampling

- Measures of Central tendency and Dispersion

- Probability

- Theoretical Distributions

- Correlation and Regression

- Index Numbers

PAPER 4: BUSINESS ECONOMICS (100 MARKS)

- Introduction to Business Economics

- Theory of Demand and Supply

- Theory of Production and Cost

- Price Determination in Different Markets

- Determination of National Income

- Business Cycles

- Public Finance

- Money Market

- International Trade

- Indian Economy

ASSESSMENT CRITERIA

To pass the Foundation examination, a candidate must achieve:

- A minimum of 40% marks in each paper and

- A minimum of 50% marks in the total aggregate of all papers, all in a single sitting.

CA Intermediate

The CA Intermediate exam is a vital stage in the Chartered Accountancy qualification process. It is conducted by the Institute of Chartered Accountants of India (ICAI) and serves as the second level of examination. The exam consists of two groups, covering subjects such as Accounting, Law, Costing, Taxation, Auditing, Information Systems and Financial Management. The CA Intermediate exam is held twice a year in May and November and passing it is a significant milestone towards becoming a Chartered Accountant.

Candidates have two options to register for the Intermediate level of the CA Course

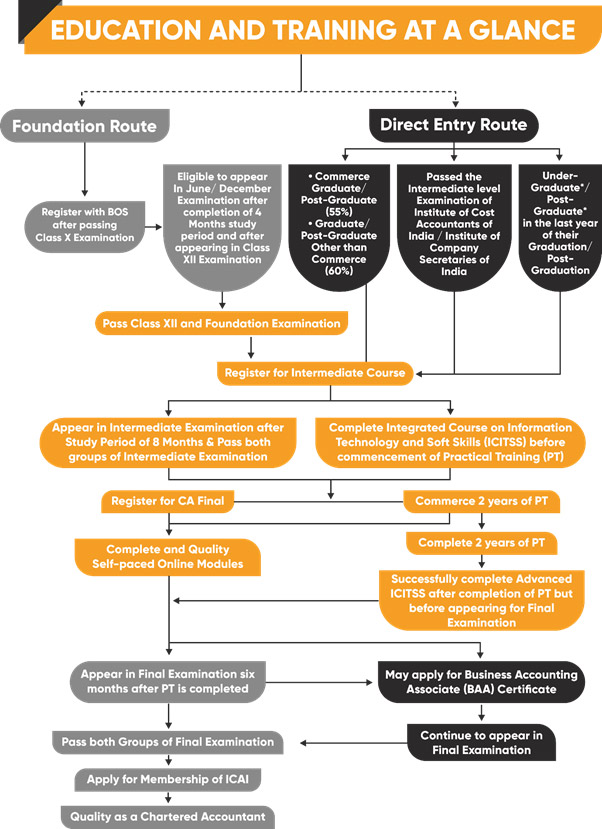

1. FOUNDATION ROUTE

Once a candidate successfully clears the CA foundation paper, they become eligible to register themselves for the CA intermediate course.

2. DIRECT ENTRY ROUTE

The ICAI allows the following candidates to enter directly to its Intermediate Course:

A. Commerce Graduates/Post-Graduates (with minimum 55% marks) or Other Graduates/ Post-Graduates (with minimum 60% marks) and

B. Intermediate level passed candidates of The Institute of Company Secretaries of India and The Institute of Cost Accountants of India.

Candidates who are Graduates/ Post Graduates in Commerce having secured in aggregate a minimum of 55% of the total marks or its equivalent grade in the examination conducted by any recognized University (including Open University) by studying any three papers carrying a minimum of 50 marks in a semester/year and cumulatively 100 or more marks over the entire duration of the concerned course out of accounting, auditing, mercantile laws, corporate laws, economics, management (including Financial Management), taxation (including Direct Tax Laws and Indirect Tax Laws), costing, business administration or management accounting or similar to the title of these papers with different nomenclatures or other than those falling under commerce stream having secured in aggregate a minimum of 60% of the total marks or its equivalent grade in the examination conducted by any recognized University (including Open University) or Candidates who have passed the Intermediate level examination conducted by The Institute of Cost Accountants of India or by The Institute of Company Secretaries of India are exempted from qualifying Foundation and can register directly to Intermediate Course.

INTERMEDIATE COURSE

PAPER 1: ADVANCED ACCOUNTING (100 MARKS)

- Process of formulation of Accounting Standards including Indian Accounting Standards (IFRS converged standards) and IFRSs; Convergence vs Adoption; Objective and Concepts of carve outs

- Framework for Preparation and Presentation of Financial Statements (as per Accounting Standards)

- Applicability of Accounting Standards to various entities

- Application of Accounting Standards

- Company Accounts

- Accounting for Branches including foreign branches

PAPER 2: CORPORATE AND OTHER LAWS (100 MARKS)

- PART I– COMPANY LAW AND LIMITED LIABILITY PARTNERSHIP LAW (70 MARKS)

- The Companies Act, 2013

- The Limited Liability Partnership Act, 2008

- PART II- OTHER LAWS (30 MARKS)

- The General Clauses Act, 1897

- Interpretation of Statutes

- The Foreign Exchange Management Act, 1999

PAPER 3: TAXATION (100 MARKS)

- SECTION A: INCOME TAX LAW (50 MARKS)

- Basic Concepts

- Residential status and scope of total income

- Heads of income and the provisions governing computation of income under different heads

- Provisions relating to clubbing of income, set-off or carry forward and set-off of losses, deductions from gross total income

- Advance Tax, Tax deduction at source and tax collection at source

- Provisions for filing return of income and self-assessment

- Computation of total income and income-tax payable by an individual under the alternative tax regimes under the Income-tax Act, 1961 to optimise tax liability

- SECTION B: GOODS AND SERVICES TAX (GST) (50 MARKS)

- GST Laws: An introduction including Constitutional aspects

- Levy and collection of CGST and IGST

- Few basic concepts

- Computation of GST liability

- Registration

- Tax invoice; Credit and Debit Notes; Electronic way bill

- Accounts and Records

- Returns

- Payment of tax

PAPER 4: COST AND MANAGEMENT ACCOUNTING (100 MARKS)

- Overview of Cost and Management Accounting:

- Introduction to Cost and Management Accounting

- Elements of Cost and preparation of Cost Sheets

- Ascertainment of Cost and Cost Accounting System:

- Material Cost

- Employee Cost

- Direct Expenses

- Overheads

- Concepts of Activity Based Costing (ABC)

- Integration of cost and financial data

- Methods of Costing:

- Single Output/ Unit Costing

- Job Costing

- Batch Costing

- Process/ Operation Costing

- Costing of Service Sectors

- Cost Control and Analysis:

- Standard Costing

- Marginal Costing

- Budget and Budgetary Control

PAPER 5: AUDITING AND ETHICS (100 MARKS)

- Nature, Objective and Scope of Audit

- Audit Strategy, Audit Planning and Audit Program

- Risk Assessment and Internal Control

- Risks-SA 330

- Audit Evidence

- Audit of Items of Financial Statements

- Audit Documentation

- Completion and Review

- Audit Report

- Special Features of Audit of Different Type of Entities

- Audit of Banks

- Ethics and Terms of Audit Engagements

PAPER 6: FINANCIAL MANAGEMENT & STRATEGIC MANAGEMENT (100 MARKS)

SECTION A: FINANCIAL MANAGEMENT (50 MARKS)

- Financial Management and Financial Analysis:

- Introduction to Financial Management Function

- Financial Analysis through Ratios

- Financing Decisions and Cost of Capital:

- Sources of Finance

- Cost of Capital

- Capital Structure Decisions

- Leverages

- Capital Investment and Dividend Decisions:

- Capital Investment Decisions

- Dividend Decisions

- Management of Working Capital

SECTION B: STRATEGIC MANAGEMENT (50 MARKS)

- Introduction to Strategic Management

- Strategic Analysis: External Environment

- Strategic Analysis: Internal Environment

- Strategic Choices

- Strategy Implementation and Evaluation

ASSESSMENT CRITERIA

To pass both groups simultaneously, a student must meet either of the following criteria:

(A) Obtain a minimum of 40% marks in each paper of Group-I and Group-II, and achieve a minimum of 50% marks in the aggregate of all the papers in each of the groups.

OR

(B) Attain a minimum of 40% marks in each paper of both Group-I and Group-II, and secure a minimum of 50% marks in the aggregate of all the papers when combined from both groups. Regarding passing a single group, a student will be declared to have passed if they meet the following requirements: Obtain a minimum of 40% marks in each paper of the specific group, and achieve a minimum of 50% marks in the aggregate of all the papers within that group.

EXEMPTIONS

- A student who fails one or more papers but obtains a minimum of 60% marks in any paper within a Group/Unit is eligible for exemption in those specific paper(s) for the next three consecutive exams.

- During this exemption period, the student must pass the remaining papers in any of the next three exams.

- To pass the Group/Unit, the student must secure a minimum of 40% marks in each paper and a minimum of 50% of the total marks, including the paper(s) where they obtained the 60% exemption. Further exemptions in the remaining papers of the Group/Unit are not granted until the student has used up their existing exemptions.

- If a candidate exhausts their exemptions and still fails the Group/Unit, they may choose to continue with the exemption but must obtain a minimum of 50% marks in each of the remaining papers to pass the Group/Unit.

Courses & Programmes

Help & Support

Visit Our Location

65, Surya Nagar, Ridhi Sidhi Crossing, Gopalpura Bypass, Near Paramhans Dham, Jaipur - 302015

Give Us a Call

+91-9513392133

Get Support

Click Here

Send us a Message